Money.Net data partners and collaborates with many firms to deliver a seamless and empowering markets experience in two ways:

- Money.Net powered applications: Some partners offer tools which consume Money.Net data in their application (MATLAB data analysis, Excel spreadsheets)

- Integrated into Money.Net: Other partners are integrated into Money.Net as a seamless value add to Money.Net customers (Riskpulse Severe Weather Tracking)

| Anchor | ||||

|---|---|---|---|---|

|

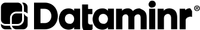

Summary: AI and Machine Learning driven up-to-the-second breaking news from social media witnesses on the scene.

Who? Demanding news consumers.

What? Real time information discovery

Where? Directly in the Money.Net Streaming News component.

How is this better than Bloomberg? Money.Net gives it to you for free, Bloomberg doesn't offer it. You can beat everyone off the starting line with breaking news that affects the markets.

Why? Because being the first to have news is power. Combined with our live squawk for verification, you can become a trading force.

How? Learn how to use the Streaming News component and Other Components.

Cost: Dataminr is available at no extra cost to Money.Net subscribers.

| Anchor | ||||

|---|---|---|---|---|

|

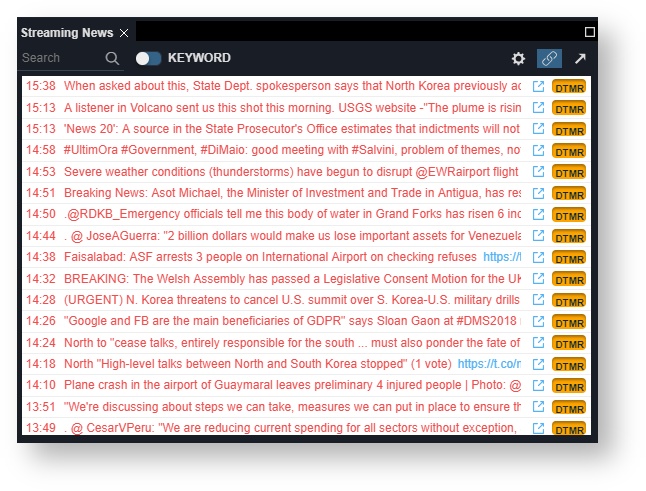

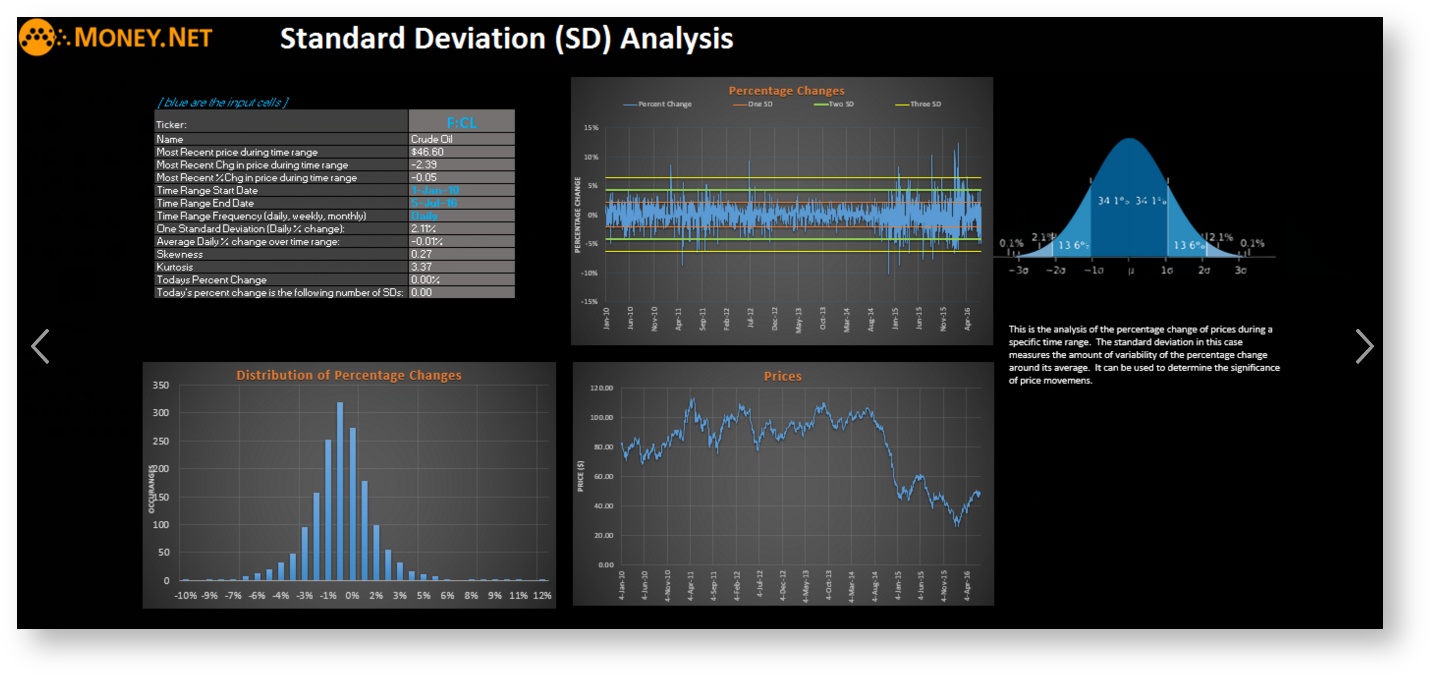

Summary: Analyze complex market data and news quickly with Money.Net data through MATLAB.

Who? Data analysts and developers. MATLAB is the easiest and most productive software environment for market data analysis by financial engineers, data scientists, financial analysts, quants, strategists, risk managers, students, and academic researchers. Banks, hedge funds, asset managers, students and academics all use MATLAB.

What? Mathematical analysis software. MATLAB (matrix laboratory) is a programming language used to mathematically analyse large amounts of data, including market data, developed by the firm MathWorks, Inc. Money.Net is a market data firm providing realtime and historical market prices, reference fundamentals like economic data, financial statements, supply and demand numbers, as well as breaking news.

Where? Step 1: One must first be a regular monthly subscription customer of Money.Net and obtain a standard Money.Net login here. Step 2: One must then purchase a copy of MATLAB from MathWorks here.

How is this better than Bloomberg? Unlike Bloomberg and other old clunky legacy expensive applications, no special add in is required to use Money.Net data in MATLAB. Money.Net just works natively with MATLAB, which is a huge benefit versus other market data vendors requiring a clunky add in to be installed and maintained.

Why? Speed and productivity. MATLAB is designed for data scientists that need to interact quickly with market data in a mathematical manner. The software allows easy 2D and 3D visualization of data, quick investigation of trade ideas using MATLAB’s extensive set of built-in math functions, and allows one to perform common mathematical tasks without having to program. The software allows for rapid curve fitting, data classification, signal analysis, and many other specific financial data tasks.

How? Learn how to use Money.Net market information through MATLAB here.

Cost: Money.Net monthly/annual subscription PLUS a purchased copy of MATLAB.

| Anchor | ||||

|---|---|---|---|---|

|

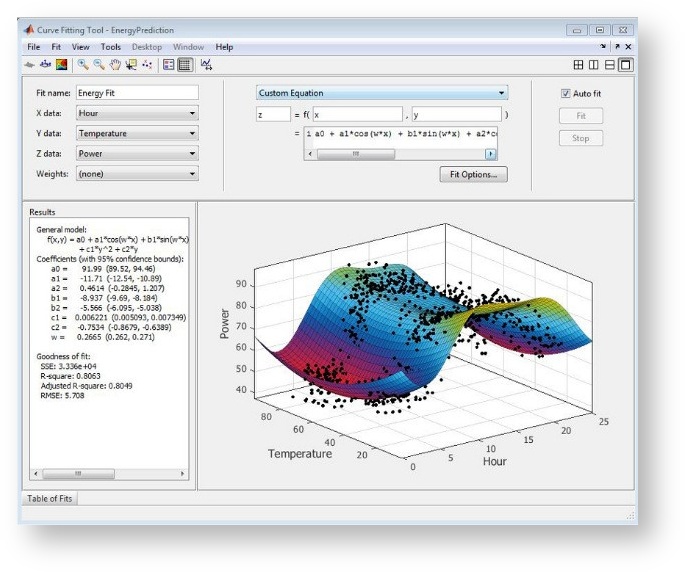

Summary: The real world in real time. Beautifully rendered and intuitive, real time mapping of global hurricanes, severe weather, earthquakes, as well as commodities assets such as oil refineries available to Money.Net customers at no additional charge.

Who? Commodity traders, logistics managers, and corporate treasuries. Some of the largest commodity trading firms, global energy producers, food shippers, auto manufacturers, and retailers use Riskpulse to support their daily operations.

What? Riskpulse is the world’s most sophisticated, yet intuitive, software used identify, manage, and optimize risks surrounding weather (heat, cold, severe storms) and other natural events (earthquakes, wildfires) influencing financial trades, transportation logistics, and specific hard assets such as oil refineries and other unmovable infrastructure. Where? One must be a regular monthly subscription customer of Money.Net and obtain a standard Money.Net login here then launch the Money.Net application, and click on ‘Modules’ -> ‘Aurora Maps by Riskpulse’.

How is this better than Bloomberg? Unlike Bloomberg, the Money.Net Riskpulse mapping system updates dynamically and automatically. Bloomberg and Thomson Reuters maps are static and have to be manually refreshed. Also, the load time of other old clunky legacy expensive mapping applications can take up to 30 seconds or more. Money.Net’s Riskpulse mapping system loads instantly. Finally, older legacy systems maps are poorly designed and are not very intuitive. Money.Net’s Riskpulse mapping system is fast, automatic, elegant, and intuitive.

Why? Weather, earthquakes and other natural events impact financial markets, particularly for commodity traders. Be the first to know before the market moves. How? Learn more about Aurora by Riskpulse and become a customer of Riskpulse’s advanced meteorological services here.

Cost: Aurora by Riskpulse on Money.Net is available at no additional charge to Money.Net customers. This is a subset of the more advanced and bespoke weather product available directly from Riskpulse. If you would like to upload your own custom assets please contact our partners at Riskpulse here.

| Anchor | ||||

|---|---|---|---|---|

|

Summary: Spreadsheets updated with fresh market data automatically. The Money.Net Excel Add-In is available to Money.Net customers at no additional charge.

Who? Anyone that interacts with financial information through Excel spreadsheets.

What? The Money.Net Excel Add-In is free software for Money.Net customers that significantly reduces the amount of time spent collecting and organizing macroeconomic data, news and market data like real time or historical prices. The Money.Net add-in provides free access to over 1,000,000 economic data series from various sources (e.g., BEA, BLS, Census, and OECD) as well as real time market prices and related fundamentals directly through Microsoft’s Excel spreadsheet.

Money.Net also provides a set of Excel spreadsheet templates to get you started and we have a team willing and able to build and convert any spreadsheets you need.

Where? Step 1: One must first be a regular monthly subscription customer of Money.Net and obtain a standard Money.Net login here. Step 2: One must have purchased a copy of Excel from Microsoft. Step 3: Install the Money.Net Excel Add-In from here.

How is this better than Bloomberg? Unlike Bloomberg, the Money.Net Excel Add-In contains more data, contains news, is more intuitive, and we don’t log users off which can impact time series analysis. Finally, older legacy systems maps are poorly designed and are not very intuitive. Money.Net’s Excel Add-In is fast, automatic, elegant, and intuitive.

In addition to Money.Net’s native data, we openly integrate the US FRED database any US EIA databases which have the following benefits:

- One-click instant download of economic time series.

- Browse the most popular data and search the FRED database.

- Quick and easy data frequency conversion and growth rate calculations.

- Instantly refresh and update spreadsheets with newly released data.

- Create graphs with NBER recession shading and an auto update feature.

Why? Excel is the most intuitive, quick way used in finance to interact with financial data and news.

How? Learn more about Money.Net’s Excel Add-In .

Cost: Money.Net monthly/annual subscription and a purchased copy of Excel.

| Anchor | ||||

|---|---|---|---|---|

|

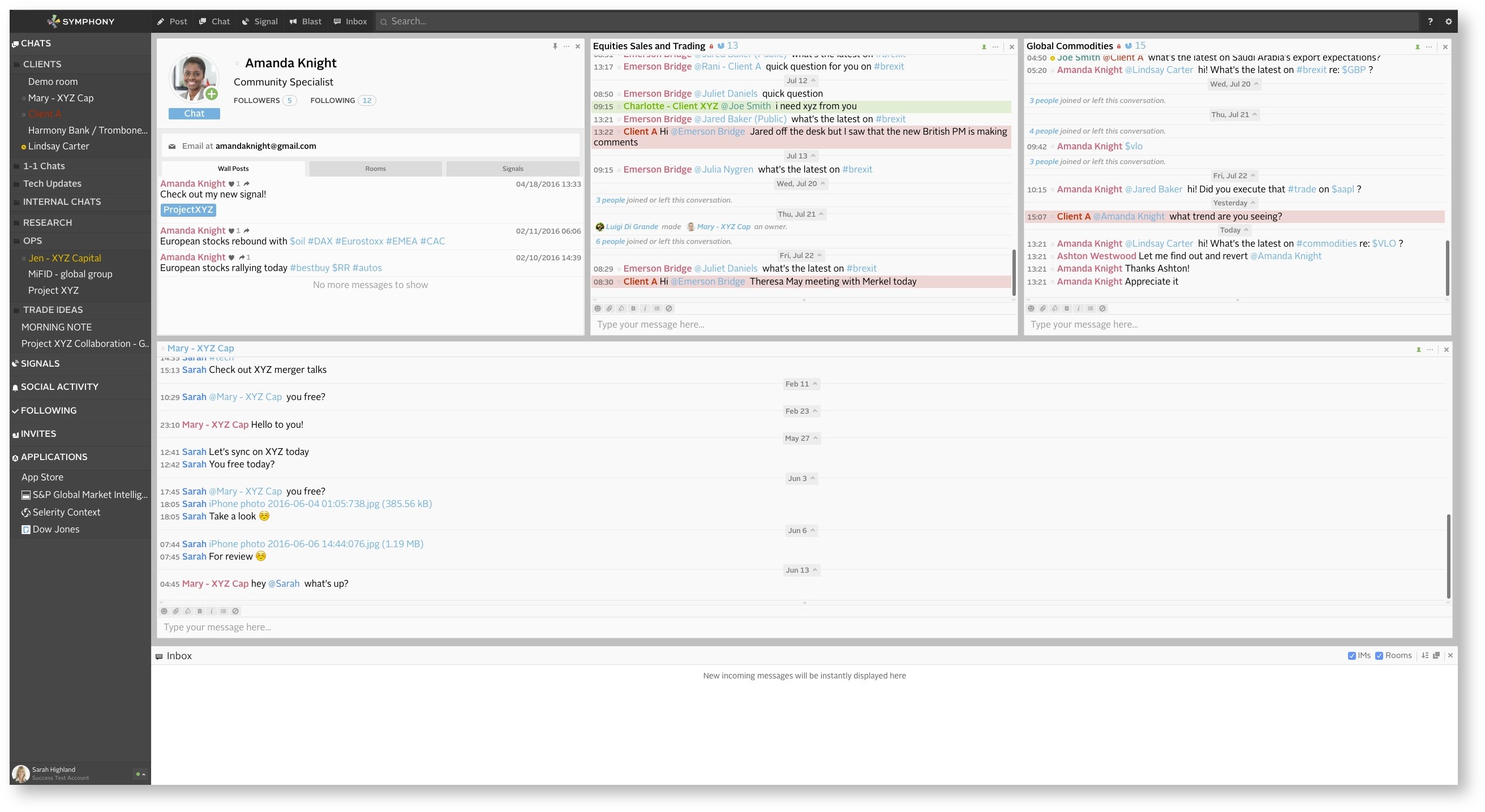

Summary: Chat securely and affordably in text form with your colleagues and customers about financial markets.

Who? Traders, sales people, research analysts, investment bankers, hedge fund portfolio managers and corporate treasurers. Symphony chat was created by a consortium of almost 20 banks.

What? Desktop and mobile communication software used primarily for financial chats. Symphony is a chat system designed for financial professionals. Money.Net provides a lot of the content and subject matter (quotes, charts, breaking news headlines) being discussed in these chats. Money.Net is a market data firm providing real time and historical market prices, reference fundamentals like economic data, financial statements, supply and demand numbers, as well as breaking news.

Where? Step 1: One must first be a regular monthly subscription customer of Money.Net and obtain a standard Money.Net login here. Step 2: One must then subscribe to Symphony here.

How is this better than Bloomberg? Bloomberg’s chat system is not encrypted. Symphony is. Symphony can also be accessed for a small monthly fee, independently from a US$25,000 Bloomberg subscription, which is what Bloomberg chat costs. Money.Net market information platform plus Symphony Chat is a complete secure replacement for Bloomberg at less than 1/15th the cost.

Why? Increased productivity, efficiency and security. Symphony is independent of any financial terminal, it is connected to many more end users, it is hugely less expensive than Bloomberg chat, and it is encrypted for security, which Bloomberg chat is not. The Symphony software allows for rapid communication of price runs, trade/hedging ideas, research, news headlines, financial analysis, and many other specific financial data tasks.

How? Single sign-in automatically each day. Money.Net customers have frictionless access to Symphony with a simple single sign in to Money.Net. When customers sign into Money.Net they will have the ability to have Symphony’s communication platform auto login seamlessly and securely. This single sign in will save mutual customers valuable time as they log in every day to Money.Net. Symphony will boot up separately in a web browser at the same time as Money.Net.

Cost: Money.Net monthly/annual subscription PLUS a monthly low cost subscription to Symphony.